12 år med WordPress

Convey er din partner når du er dybt seriøs omkring din WordPress-løsning.

Med 12 års erfaring i WordPress-udvikling leverer vi, i samarbejde med Danmarks skarpeste design- og reklamebureauer, stærke digitale løsninger til ambitiøse virksomheder og organisationer.

Convey Core Framework

WordPress sites - uden begrænsninger

Vi bygger WordPress-løsninger specifikt tilpasset din virksomhed – så hele dit team nemt kan vedligeholde og skabe indhold. Et website skal understøtte din forretning og arbejdsgange.

Unikt design

Ingen designmæssige begrænsninger

Effektiv udvikling

Fra start til slut på få uger

Simpel backend

Tilpasset de daglige arbejdsgange

Moduler

Et site bygget af moduler

Convey Central

WordPress drift - uden bekymringer

Glem alle bekymringer omkring dit websites drift. Convey Central er en WordPress-optimeret hosting- og vedligeholdelsesplatform, der sikrer at dit website kører lynhurtigt og stabilt.

Sikkerhed

Ét site pr. cloud server

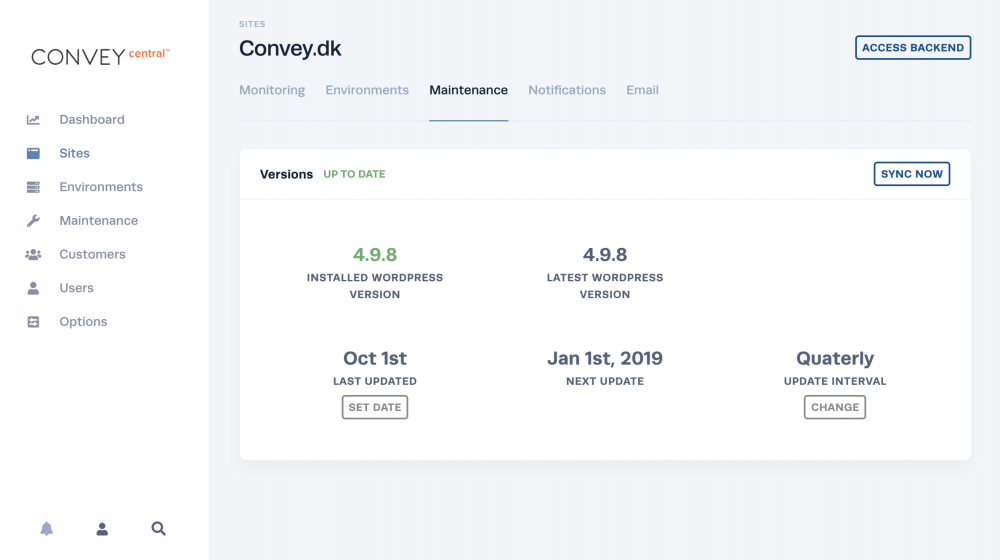

Løbende vedligehold

Opdatering af WordPress og vedligehold af servere

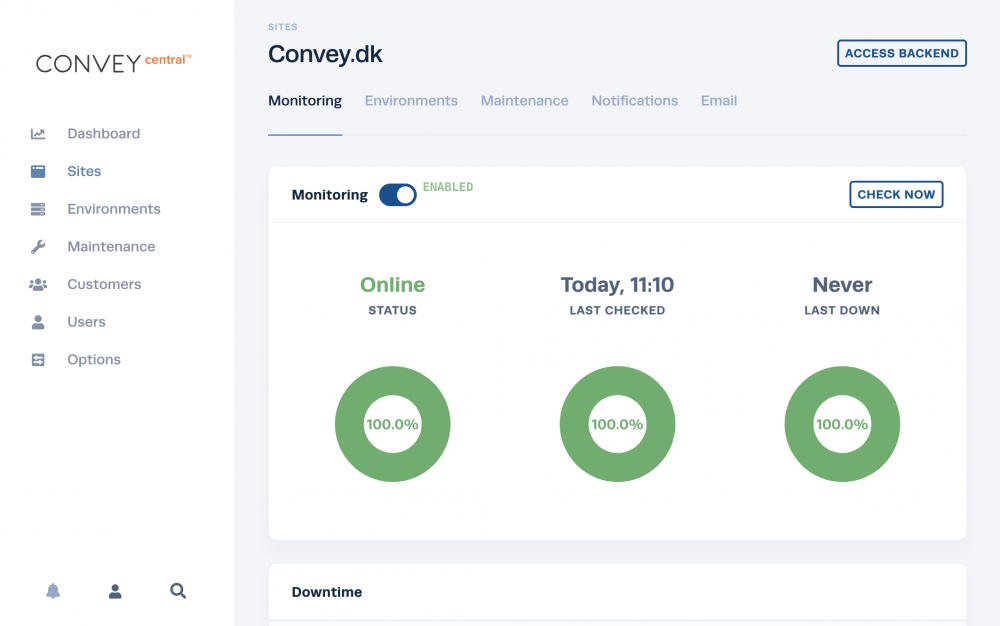

Monitorering

99,99% oppetid

24/7 monitorering

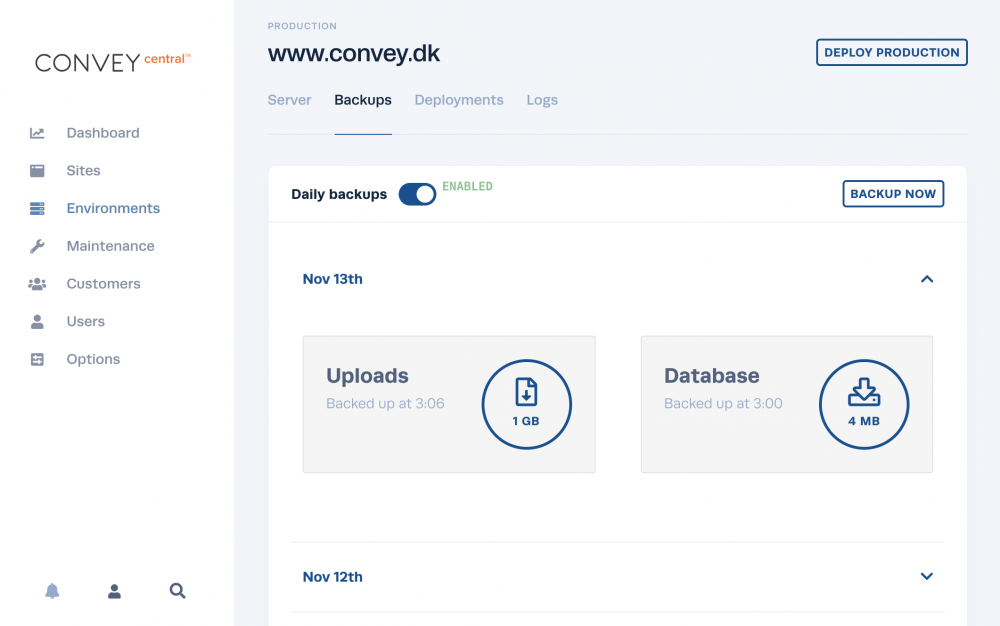

Backup

Daglig offsite backup.

Er din WordPress-side hurtig og sikker?

Scan din WordPress-side

Bureausamarbejde

Vores WordPress-løsninger er som skræddersyet til reklame- og designbureauer.

I står for koncept, design og kommunikation – vi står for udvikling og drift. Vores spidskompetence er at løse opgaver i samarbejde med reklame- og designbureauer.

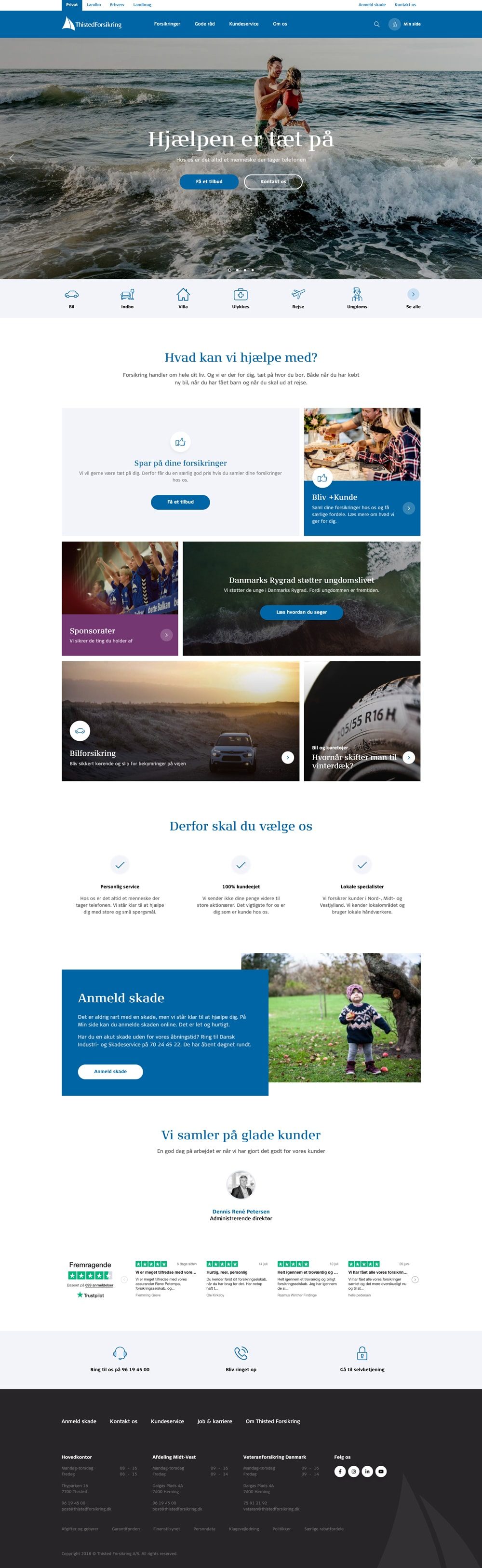

Referencer

Med ydmyghed varetager vi løsninger for